I want to bring everyone, subscribers and the general public, up to speed on the latest COVID-19 data, including some potentially good news about warming weather. As always, remember that you get the most out of this by being a subscriber.

Please recommend this to your friends by clicking the button below.

The Bailout

The financial strain on our private sector economy is nuts right now. Small businesses are closing and big businesses are laying people off.

The House Democrats’ plan is deeply flawed because it puts a burden for paid leave on small businesses and not big businesses. As Congressman Chip Roy (R-TX) points out, it does no good to burden small businesses by mandating they cover paid leave if that mandate puts them out of business. Large businesses are exempted from the requirement.

What President Trump is now outlining is a good thing. Send money directly to the workers who need it. Help small businesses with low interest (preferably no interest) loans, and prop up our banking and airline systems. While I am not a fan of bailing out airlines considering how they nickel and dime us, they actually do need the help as this is not their fault. They’re moving heaven and earth to make sure their companies are stable and they are still having trouble.

President Trump is showing the leadership the media and the Democrats have demanded. The press cannot help but attacking him nonetheless, but the public should be grateful.

Now we need Senate Republicans to fix what the House Democrats screwed up. Yes, deficits and debt matter. But right now we actually do need the federal government to engage financially to help Americans. This is another reminder that we need to work harder in good times to put us on more sound financial footing.

The bottom line is this: if I get a check I’ll use it at a small business to help them. But I know people who need this money to pay bills and buy food because they suddenly and unexpectedly find themselves without jobs. Likewise, the government would be smart to give no-interest loans to businesses with less than 100 employees (spitballing here) to keep payroll going while employees are stuck at home. Delay repayment till January, spread out those payments over several years, and make repayment to the government a non-waivable part of the bankruptcy code in case the business still folds.

There are way more small businesses in America than large businesses and they employ more people, have the tightest margins, need the most help, and have the fewest lobbyists to advocate for them in Washington.

Hopeful Research

The University of Maryland has some research that does lend credence to the idea that COVID-1 doesn’t perform well in warm weather. From the research:

In a new paper published on the open-data site SSRN, the researchers found that all cities experiencing significant outbreaks of COVID-19 have very similar winter climates with an average temperature of 41 to 52 degrees Fahrenheit, an average humidity level of 47 to 79 percent with a narrow east-west distribution along the same 30-50 N” latitude. This includes Wuhan, China, South Korea, Japan, Iran, Northern Italy, Seattle, and Northern California. It could also spell increasing trouble for the Mid-Atlantic States and -- as temperatures rise -- New England.

“Based on what we have documented so far, it appears that the virus has a harder time spreading between people in warmer, tropical climates,” said study leader Mohammad Sajadi, MD, Associate Professor of Medicine in the UMSOM, physician-scientist at the Institute of Human Virology and a member of GVN.

Severity of Infection

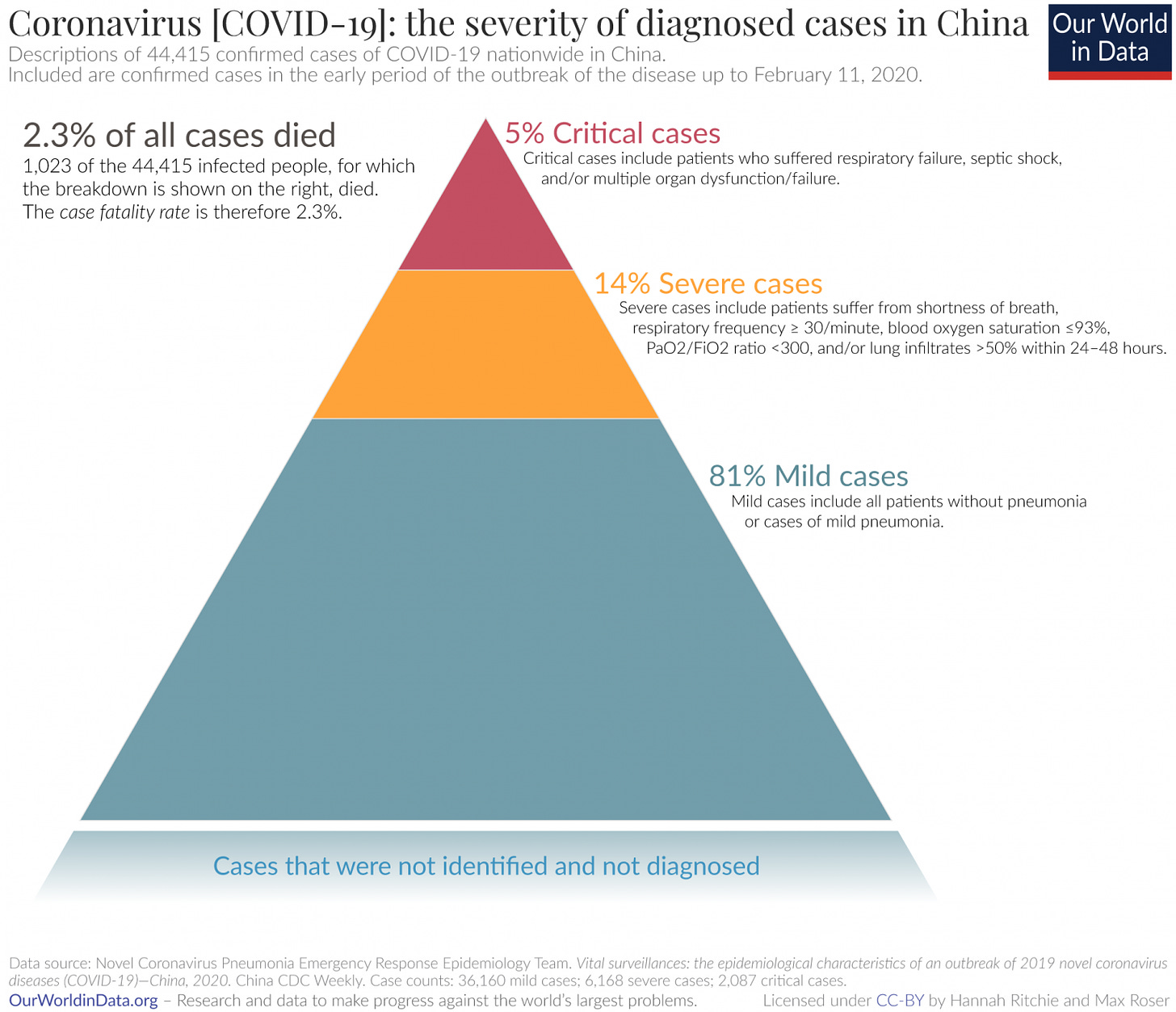

I realize this comes from Chinese data, which is suspect, but this also seems to reflect the global experience now, so I feel comfortable sharing it.

Symptoms of Infection

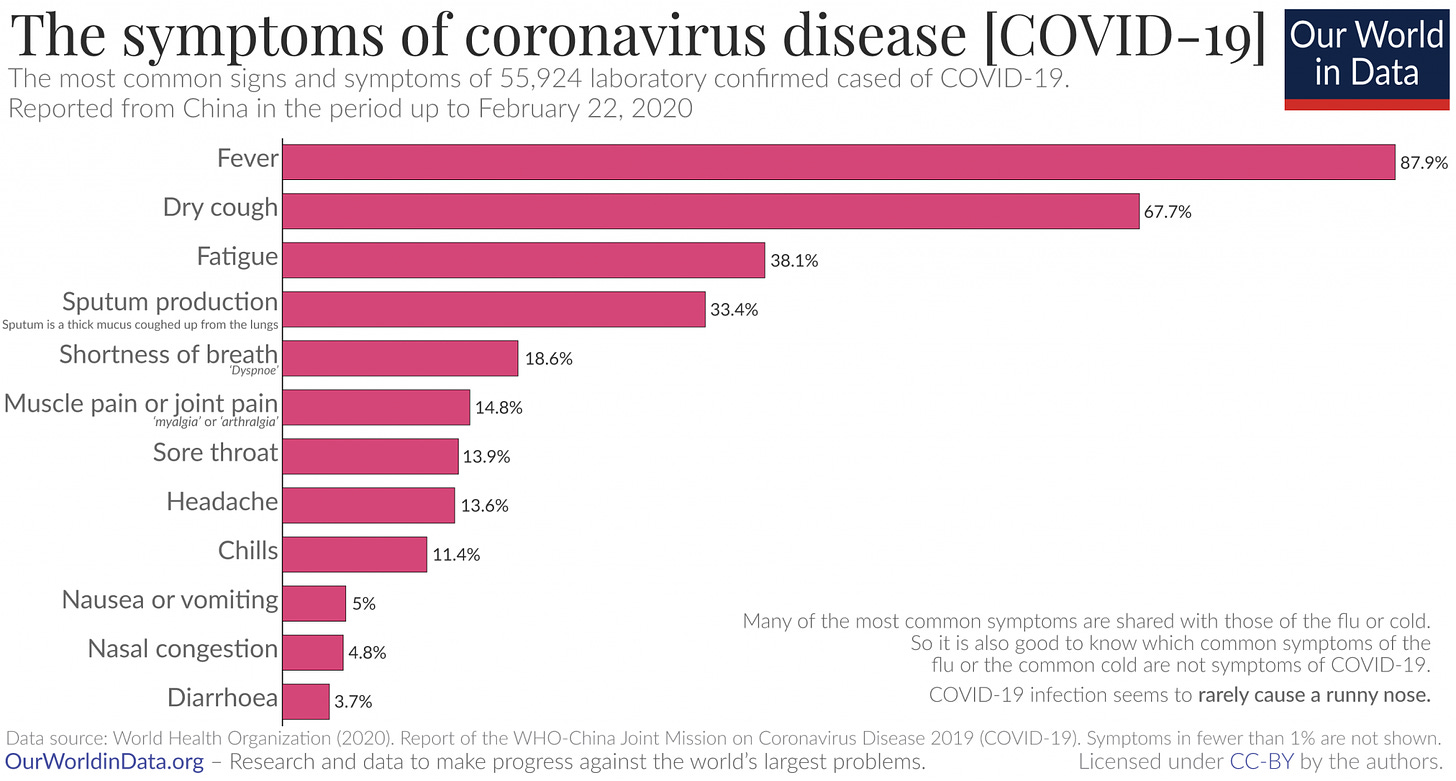

Likewise, one more chart for you. This gives a breakdown of expected symptoms. In particular, however, if you have nasal congestion and fluid in your ears, you probably have allergies or a head cold. If you have a fever and dry cough, you may have the virus.

White House Guidelines to Help Stop the Spread

The White House put these out yesterday. Bottom line is to distance yourself from others for the next fifteen days. Do this and help slow the spread. Remember, this is about managing the spread and saving as many lives as possible. Do your part.

Audit of the Spread

In the United States, at this writing, there are 5,853 cases. Most of them are mild cases. 97 people have died, though I see news reports that we’ve actually crossed 100 deaths. Just about all of them are 65 or older and most had pre-existing conditions. Technically, only 17 people have recovered, but that’s because testing is in short supply still so lots more have recovered, but only 17 are confirmed recovered.

The small biz plans I've been hearing are NO HELP to the small biz. I own 2 small businesses, with a total of 24 employees. One of the businesses has programming staff that works remotely, only, so no problem. The other business is a manufacturing company with 20 employees and tight margins. We primarily manufacture goods for construction projects where the ultimate project owner is the Army Corps of Engineers. Since our products are custom for each installation, we have no inventory. If our team isn't working, we aren't making any money, just like a restaurant. Loaning me money to pay employees while they aren't working isn't going to help one bit. Since we are in construction, we have regular layoffs, as any construction outfit does, depending primarily on weather and political decisions. When work stops, my workers stay afloat through the unemployment system. We offer a great benefit package for a small company with paid vacations, paid holiday's, health insurance plan, accident insurance plan, life insurance plan, and 401K plan. Keeping up with the benefit payments for the employees while they are on layoff is hard enough, but burdening my with also keeping up with payroll is just the type of assistance I cannot afford. Later when the workers are back on the job, and those loans come due, even at zero interest, the margins are not sufficient enough to double my labor overhead and remain afloat. Its just that simple. A more reasonable assistance to small biz would look something like: 1. Take care of the employees on layoff by propping up the unemployment systems of the states and not requiring affected workers to have a multi-week delay prior to receiving benefits

2. Assist the businesses with fixed overhead, NOT SURE what this would look like...still the Peter and Paul issue of borrowing from future proceeds. These fixed overhead issues would be enough to put small biz under in and of itself, so this is where the assistance is needed.

I'm sure there are other things that would be more reasonable than a loan.

Great comments Erick on all points. Properly budgeting spending is important but so is responding to emergencies. A possible worst case outcome of not taking steps to slow/stop the spread of Corona is something like a million dead US citizens (+/- a great bit of uncertainty). This has forced governments at all levels to shut down portions of the economy to try to prevent that health emergency. Consequently, governments of all levels are responsible for the economic consequences of temporarily shutting down the economy. And the Democrats answers (like universal health insurance) haven't worked to slow the spread in Europe. In fact, within a week after Trump shut down travel from EU, the EU countries are shutting down travel, closing borders, and locking down their country, because it is the most sensible plan for slowing/stopping the spread of the virus.